How to Redeem Travel Credit Card Points for Maximum Value

Disclaimer: This post may contain affiliate links. Please see our Disclosure Policy and Advertiser Disclosure for details.

Editorial Disclaimer: Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

The allure of redeeming travel points for luxurious getaways and first-class flights is irresistible. Travel Credit Card points have allowed people to experience some once in a lifetime travel experiences that they may not have been otherwise been able to afford. However, navigating the world of travel rewards can be complex, especially if you’re brand new to using points and miles.

We’ve been collecting points and miles via our travel credit card spending for years now to redeem bucket list trips of ours, and now are here to teach you how to do the same! To help you get the most out of your hard-earned points, we’ve put together this comprehensive guide on how to redeem travel credit card points and miles for maximum value.

Understanding Travel Credit Card Points

Before diving into the strategies, it’s essential to understand what travel credit card points are. They are their own rewards currency. Travel points are rewards earned through travel credit cards for various spending activities. These points can be redeemed for flights, hotel stays, car rentals, and more. Different credit cards offer different points structures and redemption options, so knowing the ins and outs of your specific card is crucial.

Key Strategies for Maximizing Travel Points

1. Choose the Right Credit Card

The first step to maximizing travel points is selecting the right travel credit card. Look for cards that offer generous sign-up bonuses, high points per dollar spent on travel-related purchases, and flexible redemption options. Cards like the Chase Sapphire Preferred® Card, the Platinum Card® from American Express, and the Capital One Venture X Rewards Credit Card are known for their excellent travel rewards programs.

Chase Sapphire Preferred® Card

Our Go To Personal Travel Credit Card

- 5X per $1 on travel purchased through Chase Travel

- 3x points on dining, including eligible delivery services, takeout, and dining out

- 2x points on travel purchases

The Platinum Card® from American Express

Our Go To Travel Card for Frequent Fliers

- 5X per $1 on up to $500,000 per calendar year on flights booked directly with airlines or through American Express Travel

- 5x per $1 on eligible prepaid hotels booked including The Hotel Collection

- 1X per $1 on other purchases, terms and limitations apply

2. Focus on Welcome Offers

Welcome offers are the quickest way to accumulate a large number of points. Many travel credit cards offer substantial bonuses if you meet a minimum spending requirement within the first few months. Plan your spending to ensure you hit these thresholds without incurring unnecessary expenses.

If you have any upcoming large expenses, like hosting a wedding, buying furniture for your home, or anything else in that realm, we always like to take advantage of timely welcome offers that you’ll hit with your already budgeted money.

3. Understand Points Valuation

The biggest thing to know when starting out with points and miles redemptions is that not all points are created equal. The value of your points can vary significantly depending on how you redeem them. For example, redeeming points for flights or hotel stays often provides more value than using them for gift cards or merchandise. Research the average value of points for your specific card to make informed redemption decisions.

There are great tools and extensions like Points Path that can help you determine if booking a flight would be more beneficial to book via points versus paying in cash.

Additionally, utilizing a fare drop subscription like Fare Drop or Thrifty Traveler Premium can make sure your points are doing the most in terms of value for you as they send out incredible deals that alert you when regular points redemptions are lower than usual. You can use our code PASSPORT10 to save $10 off your first year! We have personally saved thousands of dollars and points this way.

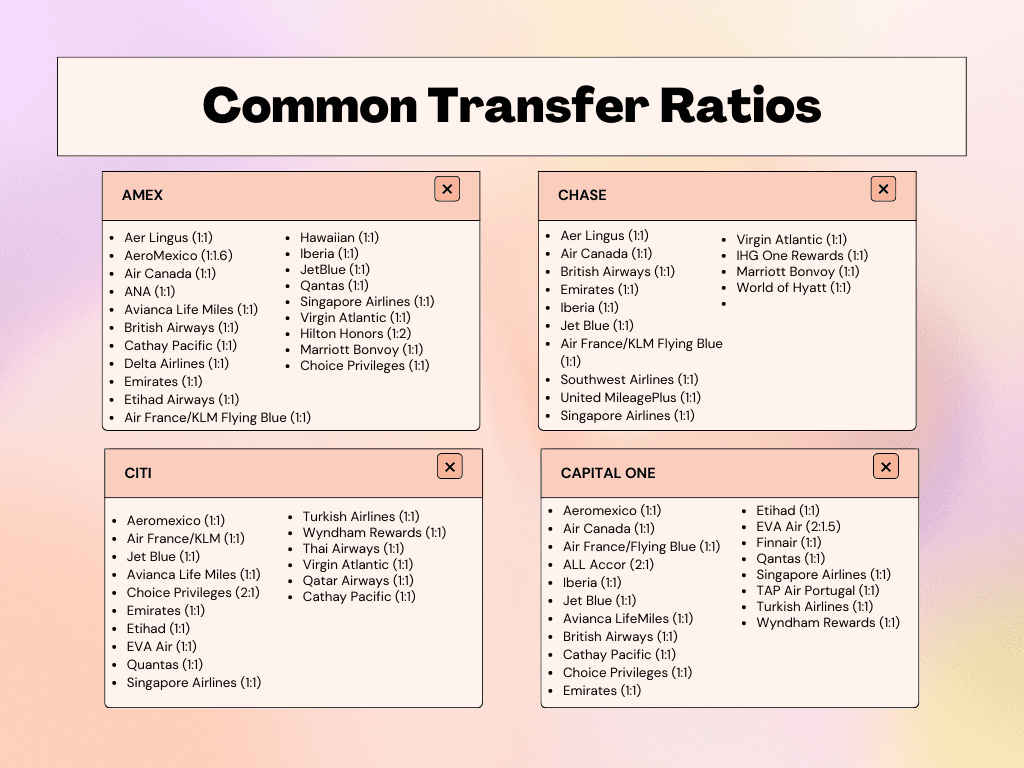

4. Utilize Transfer Partners

One of the best ways to maximize the value of your travel points is by transferring them to airline or hotel loyalty programs. Many credit card issuers have partnerships with major airlines and hotel chains, allowing you to transfer points at favorable rates. This can often double or triple the value of your points compared to redeeming them directly through the credit card’s travel portal.

Sometimes you will get better redemption values for the exact same flight by simply booking it through an airline or hotel’s transfer partner. We love using websites like Point.Me to find the cheapest points redemptions possible for a particular flight route. If you have an AMEX card, you can now access this tool for free which is a huge perk!

5. Book Flights and Hotels Strategically

Timing is everything when it comes to booking travel with points. Look for off-peak times, last-minute deals, and special promotions that can stretch your points further. Flexibility with your travel dates and destinations can also open up more opportunities for better redemption rates.

6. Take Advantage of Special Offers and Promotions

Credit card companies and travel partners frequently offer limited-time promotions that can significantly boost your points’ value. These offers might include bonus points for specific types of purchases, discounted points redemptions, or extra points for booking through a particular portal.

7. Combine Points with Cash

Sometimes, using a combination of points and cash can yield the best value. This strategy allows you to stretch your points while still enjoying significant savings on travel expenses. Be sure to compare the cost in points versus cash to ensure you’re getting the best deal.

Advanced Tips for Expert Travelers

For those who have mastered the basics, here are some advanced strategies to further maximize your travel points:

Leverage Multiple Credit Cards

Using multiple credit cards strategically can help you earn more points and take advantage of various rewards programs. For example, you might use one card for everyday purchases and another for travel-related expenses to maximize your points earning potential.

Currently, we have over 10+ credit cards in our repertoire which we utilize for different spending categories. By having credit cards across brands, you are able to take advantage of most points and miles rewards programs.

If you are interested in getting really advanced – you can even get into having multiple credit cards for both personal and business spending. AND, if you have a spouse or partner that you travel with, you can also refer each other to build up your credit card portfolio while hitting great welcome offers via referrals.

Participate in Loyalty Programs

Join airline and hotel loyalty programs to earn additional points and enjoy exclusive perks. Many programs offer elite status tiers that provide benefits like free upgrades, priority boarding, and bonus points for every stay or flight.

Every time we stay at a new hotel, fly on a new airline, or use a different rental car agency, we always make sure to create a loyalty account so that we can make sure we’re taking full advantage of their rewards programs.

Monitor Points Sales and Buy Points Strategically

Occasionally, airlines and hotels offer promotions where you can buy points at a discount. While buying points isn’t always the best deal, it can be beneficial during promotions or if you need to top off your points balance for a specific redemption.

Maximize your points’ value by redeeming them for premium travel experiences like first-class flights, luxury hotel stays, or unique travel packages. These redemptions often offer the highest value per point and provide unforgettable experiences.

Conclusion

Redeeming travel points for maximum value requires a combination of strategy, knowledge, and flexibility. By choosing the right credit cards, understanding points valuation, and taking advantage of transfer partners and promotions, you can make your travel dreams a reality while getting the most bang for your buck. Start planning your next adventure today and see just how far your travel points can take you!

Disclaimer: Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

You may also enjoy: