Getting Started with Points & Miles: A Beginner’s Guide to Travel Credit Cards

Disclaimer: This post may contain affiliate links. Please see our Disclosure Policy and Advertiser Disclosure for details.

Opinions expressed here are the author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post. If you choose to apply for any of these credit cards through our affiliate link, we make a commission at no extra cost to you!

Disclosure: Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by

Amex Assurance Company.

A travel credit card (or a couple of them) is a great tool that all financially responsible travelers should be using. Utilizing travel credit cards is a great way to save money and offset costs on your trips. In fact, as full time travel creators, we think using travel credit cards is one of the best ways to be able to experience bucket list destinations. By using our cards on everyday expenses, we can accumulate points and miles so that we can save money on flights, hotels, and other travel-related expenses.

This requires careful planning, research, and management of rewards programs and credit cards, but the potential savings can make it a valuable investment of time and effort for frequent travelers. However, knowing which travel credit card(s) to apply for can be confusing, which is why we’ve put this beginners guide together!

Points and miles can easily save you thousands of dollars in travel expenses and enable you to enjoy luxurious experiences that you otherwise might not be able to afford. We’ve been using travel credit cards strategically for the past three years, used them to go on our dream French Polynesia honeymoon & a dream trip to New Zealand for practically free, and have gathered some essential tips on how to get started with points and miles as a beginner with Travel Credit Cards.

How to Get Started in the Reward Travel Space

Why Should You Accumulate Points & Miles?

The strategy behind using points, miles, and cash back rewards to travel is essentially to use loyalty programs, leverage travel partners, and optimize travel credit card welcome offers and spend categories to earn rewards, which subsequently can be exchanged for free travel experiences. This is achieved by earning and redeeming frequent flier miles, credit card points via spending and Welcome Offers, and hotel loyalty points, which can be transferred to partnering airlines, hotels, and experiences for free or discounted travel.

Are Travel Credit Cards for You?

Using travel credit card rewards to book trips is a strategy for smart travel planning, where travelers can earn and redeem rewards to save money and enjoy better travel experiences. That said, this is not for everybody. This article is for those that meet the criteria below:

- USA Residents: The strategies we discuss here are mainly applicable for United States residents. The cards we’ll be discussing apply to benefits for those exclusively living in the USA.

- Good Credit Score: This process is typically for those with credit scores of over 700 with good credit. If you are not in the financial place to start using travel credit cards- you might want to postpone applying for travel credit cards until you have enough to pay down your debt in its entirety each month. The APR isn’t worth it if you intend to keep a balance on the cards.

- Organized: You need to be organized. Keeping track of deadlines, credit card welcome offer dates, and travel plans requires an attention to detail!

- Debt Free: We wouldn’t recommend this as a strategy for those trying to get out of a lot of debt. We do not advocate spending more money than you have to get points and miles. We only recommend using these strategies if you are in the position to pay off your cards before the statements are due each month.

Minimize Using Debit Cards

We basically never use a debit card anymore and here’s why – debit cards don’t get you valuable rewards points or miles. We also only use travel credit cards knowing that we can pay them off at the end of each statement period so they essentially work like debit cards for us.

Travel credit cards also give you additional protections that most debit cards do not offer. These range from lost baggage insurance, delayed travel insurance, trip cancellation insurance and more. So, we’d recommend to stop using debit cards when possible and switch to a travel credit card that will reward you with more value via points, miles, and travel insurance for your money spent.

Enroll in Airline & Hotel Loyalty Programs

The first step in your points and miles strategy should be to enroll in rewards programs offered by airlines, hotels, and car rental companies. This way, you can earn points or miles every time you travel and use them to book future trips for free or at a discounted rate. Any time we fly an airline, we make sure to sign up with their individual program. This also helps with gaining status on each airline or hotel for future benefits.

We keep a running spreadsheet of all of our different loyalty program numbers and login information to keep organized. When you book flights or hotels, simply insert your loyalty number when checking out to gain automatic rewards points that you can accumulate over time to cash out for free future experiences.

Utilize Airline Price Drop Softwares

We personally use Thrifty Traveler Premium and Fare Drop to get daily notifications of amazing flight deals or miles redemptions in our email everyday. If you’d like to sign up for Thrifty Traveler Premium, use our referral code PASSPORT10 to get $10 off your subscription! We personally think it’s 100% worth the price as their deals have saved us thousands in flights.

Use Credit Card Rewards

Many credit cards offer rewards for spending, such as miles, points or cash back. Choose a card that offers rewards that you can redeem for travel, like flights or hotel stays. Check out our top recommendations here.

We utilize a mix of personal and business credit cards. For those that are self-employed or freelancers, taking advantage of both can be super helpful with points and status. However, in order to qualify for business credit cards, you’ll need to make sure you have a business structure in place with a valid EIN number.

Be Flexible With Your Itinerary

Flexibility can save you money on your trips. Be open to making changes to your itinerary if you find a better deal or if your plans change. Most of the time, if you travel during weekdays over weekends you’ll be able to save some money. Additionally, by not selecting certain dates and rather looking at full months to book flights, you’ll be able to take advantage of more flight deals.

We always recommend making a list of bucket list locations you want to visit. From there, keep track of flight fare drops and points redemption deals for those locations.

The Best Travel Credit Cards for Beginners

Using a travel credit card with rewards like points, miles, or cash back is one of the easiest ways to earn “free” travel. Now, it should be mentioned that you don’t have to focus on spending a ton of money to get points; rather, focus on maximizing your everyday purchases by strategically using credit cards with rewards points to pay for your pre-existing expenses to eventually offset the cost of future travel. Just make sure to choose a card that offers rewards for the type of travel you prefer.

Our Top Recommendations for All Around Travel Credit Cards

I’ve personally had the Chase Sapphire Preferred® Card for four years now, and I can honestly tell you its benefits and flexibility make it one of the most consistent cards on the market, making it ideal for travel newbies and experts alike.

If you’re looking to get started in the miles and points game, having the Sapphire Preferred in your wallet is simply a no-brainer. Not to mention, it’s a really affordable card. From personal experience, this card has been my go to earner for points that I’ve redeemed for some pretty incredible vacations and award redemptions, all while paying a very small annual fee.

It typically offers a generous Welcome Offer and rewards for travel and dining expenses, as well as the ability to transfer points to a variety of travel partners.

Pro Tip: If you’re looking for more of an intermediate card with elevated perks, then upgrading to the Chase Sapphire Reserve® may be right for you!

The Capital One Venture X Rewards Card is an excellent choice for beginner or intermediate travelers looking to delve into the world of travel credit cards. Known for its simplicity and robust rewards system, this card offers a variety of benefits that make it appealing for both novice and experienced travelers. With an annual fee of $395, this is a great travel credit card for those on a more moderate budget.

The Capital One Venture X Card often comes with a substantial welcome offer. Cardholders earn 2X miles on every purchase, every day. Additionally, you can earn 10X miles on hotels and rental cars booked through Capital One Travel, and 5X miles on flights booked through Capital One Travel. This straightforward earning structure makes it easy for beginners to accumulate points quickly.

If you’re an avid traveler, you’ll also love other perks like Priority Pass benefits, No Foreign Transaction Fees, and $300 in annual travel credit for bookings made through Capital One Travel.

The American Express® Gold Card is a fantastic choice for beginners who are looking to maximize their rewards through everyday spending, particularly on dining and groceries.

Once enrolled, the 4X points on dining at restaurants (up to $50,000 per year, then 1x after) and U.S. supermarket purchases (up to $25,000 per year, then 1x after) on these purchases per calendar year make it easy for beginners to rack up points quickly through everyday expenses, and the annual dining and Uber cash can help offset the card’s $325 annual fee (Rates & Fees). Note: you must have downloaded the latest version of the Uber App and your eligible American Express Gold Card must be a method of payment in your Uber account.

With flexible redemption options and robust travel and purchase protections, the Amex Gold Card provides a strong foundation for beginners to build their travel rewards portfolio and start exploring the world with confidence.

The Business Platinum Card® from American Express

Our Go To Business Travel Card

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The Business Platinum card is a premium business travel card offering a range of exclusive travel and business benefits, including airport lounge access, annual airline fee credits, and 5X Membership Rewards points on flights and prepaid hotels through Amex Travel. This card is a must have in our wallet as business owners who travel super frequently.

With a higher $695 annual fee (see Rates & Fees), this card is designed for individuals or businesses looking to elevate their travel experience and enjoy a suite of luxury perks— but because of its annual fee, it might not be worth the money for all business owners or travelers.

We personally love this card since it comes with Complimentary access to The Global Lounge Collection that includes 1,400+ lounges, up to a $200 Airline Fee Statement Credit, and up to a $189 CLEAR® Plus Statement Credit, and more when you enroll! This is our #1 Most Used Business Card! If you don’t run a business, we’d recommend checking out the personal card as well.

The Chase Ink Business Unlimited® Credit Card is a top choice for small business owners and entrepreneurs looking to streamline their expenses and earn rewards on everyday business purchases. Known for its simplicity and valuable rewards program, this card offers a flat-rate earning structure, making it easy for beginners to accumulate points without the need to track spending categories.

This card is great for those starting out with travel credit cards that haven’t figured out their top spending categories yet since you’ll get 1.5% points on all purchases, with no limits on the amount you can earn. This was the first credit card we had for our business.

Our Top Recommendations for Loyalty Based Travel Credit Cards

We recommend choosing to be loyal to one to a few different airlines or hotel chains once you start traveling more. This will make your future travel benefits so much more lucrative than if you were to continuously fly different airlines all of the time. Our personal favorites are the following:

Delta SkyMiles® Platinum Business American Express Card

Our Favorite Delta Loyalist Credit Card

Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

The Delta SkyMiles® Platinum Business American Express Card is an ideal choice for business owners who frequently fly with Delta Air Lines. We’ve flown almost every domestic airline in the USA in the past few years and have definitely noticed that Delta offers the most premium service when compared to other airlines. It is our personal favorite airline to fly domestically and internationally.

Once enrolled, you’ll enjoy perks like First Checked Bag Free, Priority Boarding, an annual Companion Certificate, and potential Status Boost® after qualified spending to help you achieve or maintain Medallion Status with Delta. Even with an annual fee of $350 (Rates & Fees), we find that the associated benefits definitely make up for the card’s initial costs if you fly Delta frequently.

The Marriott Bonvoy Boundless® Credit Card is an excellent choice for travelers who frequently stay at Marriott properties. We are Platinum Status at Marriott properties, so having a Marriott Bonvoy Boundless personal card just made sense for us.

The Marriott Bonvoy Boundless® Credit Card offers a competitive earning structure:

- 6X points per $1 spent at over 7,000 participating Marriott Bonvoy hotels.

- 3X points per $1 spent on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining.

- 2X points per $1 spent on all other purchases.

We personally love that you can receive a free night award every year after your account anniversary, valid for a one-night stay at a property with a redemption level up to 35,000 points. This benefit can offset the card’s $95 annual fee (see Rates & Fees) and provide significant value.

You also get to enjoy automatic Silver Elite status as a cardholder, which includes benefits such as priority late checkout, a 10% bonus on points earned for stays, and more. Plus, you can earn Gold Elite status by spending $35,000 on purchases each account year. Whether you’re looking to earn free nights, enjoy elite benefits, or simply make the most of your Marriott stays, the Marriott Bonvoy Boundless® Credit Card offers a comprehensive and rewarding solution for your travel needs.

Easy Ways to Earn Points and Miles

Now that you know which travel credit cards to use, we can get into the best ways to earn points and miles for travel.

Take Advantage of Welcome Offers

When applying for travel credit cards, look for welcome offers from travel rewards programs and credit card companies. For example, you may be able to earn extra points or miles by making a certain amount of purchases within a specified time frame. Typically, we personally try to enroll for certain ideal travel credit cards when there is a welcome offer of 75,000 points or higher.

Utilize Rewards Portals

When you book travel through rewards portals, you typically earn even more points than on everyday purchases. Many airlines, hotels, and travel companies offer rewards portals where you can book travel and earn extra points or miles. For example, if you book through the AMEX Travel Portal with your Amex Platinum Card, you can get 5x the amount of points on flights or hotels (up to $500,000 on these purchases per calendar year) that you’d normally get if you were to book the same flight not in their portal.

Travel portals like this are also where you can redeem points for flights if you’d rather pay for them in points instead of cash. You can typically select which option you would like to use at checkout.

Be Strategic with Everyday Purchases

Many travel rewards programs allow you to earn points or miles for everyday purchases, such as groceries, gas, and online shopping. We typically make a chart detailing which travel credit cards are the best for each spending category. That way, we can maximize each card for the most amount of points and miles possible.

If you are about to have some bigger upcoming purchases and want to cash out on points and miles, we’d highly recommend opening a new credit card with a hefty welcome offer. This way, you can rack up a ton of points and/or miles with just a handful of purchases.

For example, as we planned our wedding, we opened up a new travel credit card and had put all expenses on that card so we could hit the 3 month welcome offer and continue to get points on expenses as we spend for that particular event. From all the points and miles we are getting from just putting those purchases on a new credit card, we were able to redeem our credit card rewards for an almost entirely free honeymoon.

Using Alliances with Points & Miles

There are various different alliances of corporations that have teamed up so that you can earn and utilize points across their alliance members. You’ll want to get familiar with these as you get into booking travel with points more often.

For example, let’s say I’m flying from Los Angeles to Doha via Qatar Airways. Qatar Airways has many alliance members in the One World Alliance including American Airlines. If I’m flying a route to Qatar with Qatar Airways, since I am an American Airlines Aadvantage member, I can actually choose to earn Aadvantage points instead of Qatar Airways points to help increase my rewards on American as they are in the same alliance. Likewise, I can transfer my American miles to Qatar Avios for an awards seat redemption if I wanted to.

We’ve listed out the most common alliances used below:

| Star Alliance: | One World Alliance: | Skyteam Alliance: |

| Aegean Airlines Air Canada Air China Air India Air New Zealand All Nippon Airways (ANA) Asiana Austrian Airlines Avianca Brussels Airlines Copa Airlines Croatia Airlines EgyptAir Ethiopian Airlines EVA Air LOT Polish Airlines Lufthansa Scandinavian Airlines (SAS) Shenzhen Airlines Singapore Airlines South African Airways Swiss Airlines TAP Portugal Thai Airways Turkish Airlines United Airlines | Alaska Airlines American Airlines British Airways Cathay Pacific Finnair Iberia Japan Airlines Malaysia Airlines Qantas Qatar Royal Air Maroc Royal Jordanian S7 Airlines SriLankan | Aeroflot Aerolíneas Argentinas Aeromexico AirEuropa Air France Alitalia China Airlines China Eastern Czech Airlines Delta Garuda Indonesia ITA Airways Kenya Airways KLM Korean Air MEA Saudia Tarom Vietnam Airlines Virgin Atlantic (joining early 2023) XiamenAir |

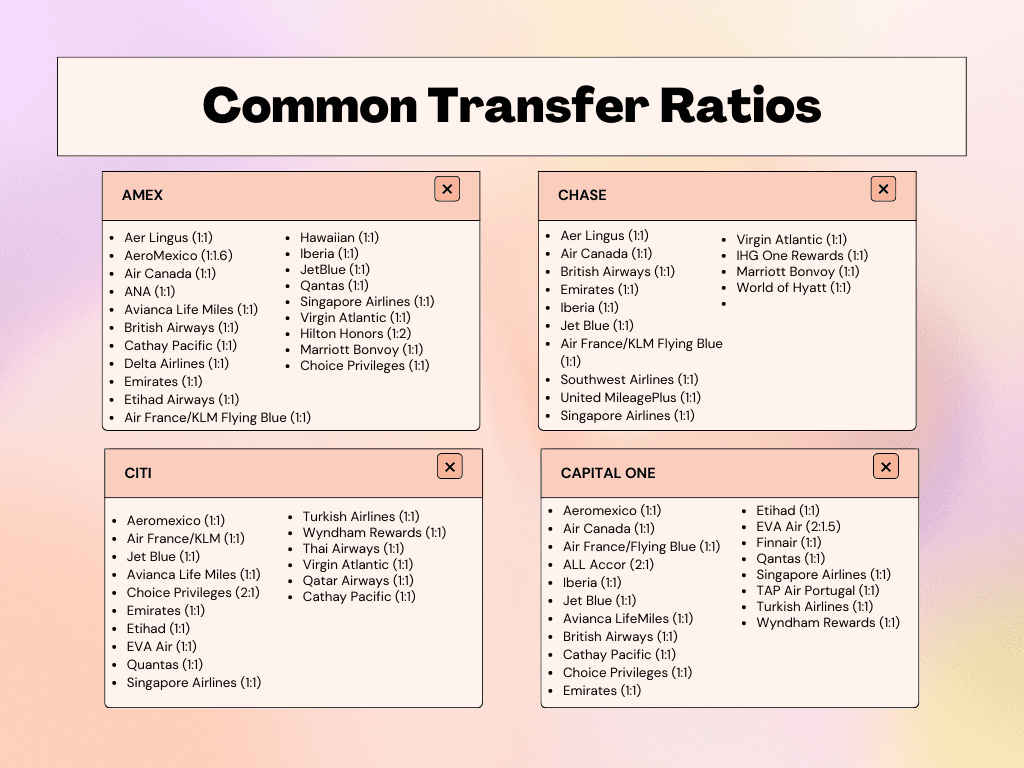

Transfer Points and Miles

Similar to transferring points between alliances, some travel rewards programs allow you to transfer points and miles to other programs. Keep in mind, you can only book through either a portal or a transfer partner when redeeming points.

The nice thing about gaining points over miles is that you have much more flexibility when it comes to your transfer partners and where you can use your points. Whereas with miles, you can only typically use them to book flights.

When transferring from a portal to an airline, don’t forget that you are stuck using those points with ONLY that airline after the transfer is over. Subsequently, make sure to be 100% positive that you want to book a flight or hotel and it’s indeed available before you transfer your points over. We’d recommend calling to confirm availability.

Additionally, some points may lose or gain value depending on who you were to transfer them to. Partners like Marriott Bonvoy often use a 3:1 transfer ratio to its partners so every 3 Marriott points is only 1 point of a Chase point, for example.

Sometimes, partners will run promotions to encourage you to book flights on partner airlines though, where your points will actually be more valuable than before. Always make sure to check your transfer ratio before you move points or miles around.

For a list of common transfer partners, check the list below:

Common Transfer Partners:

| Chase Partners | AMEX Partners | Citi Partners |

| Airlines: Aer Lingus AerClub Air Canada Aeroplan Air France-KLM Flying Blue British Airways Executive Club Emirates Skywards Iberia Plus JetBlue TrueBlue Singapore Airlines KrisFlyer Southwest Airlines Rapid Rewards United MileagePlus Virgin Atlantic Flying Club Hotels: IHG Rewards Club Marriott Bonvoy World of Hyatt | Airlines: AeroMexico Aer Lingus Air Canada Alitalia ANA Cathay Pacific (Asia Miles) Avianca British Airways Delta Emirates Etihad Flying Blue (Air France / KLM) Iberia Hawaiian Airlines JetBlue Qantas Singapore Airlines Virgin Atlantic Hotels: Choice Hotels Hilton Marriott | Airlines: Aeromexico Club Premier Air France-KLM Flying Blue Avianca LifeMiles Cathay Pacific Asia Miles Emirates Skywards Etihad Guest EVA Air Infinity MileageLands JetBlue TrueBlue Malaysia Airlines Enrich Qantas Frequent Flyer Qatar Airways Privilege Club Singapore Airlines KrisFlyer Thai Airways Royal Orchid Plus Turkish Airlines Miles&Smiles Virgin Atlantic Flying Club |

Participate in Promotions

Lastly, keep an eye out for special promotions and offers from travel rewards programs and credit card companies, as these can be a great way to earn extra points and miles.

By taking advantage of these opportunities, you can earn more points and miles and save money on your trips. Just make sure to carefully read the terms and conditions of each program to ensure you are getting the best value for your rewards.

Looking for more info on how we are able to travel so much around the world? Check out our guide to making money as a travel content creator next!

You may also enjoy: